Europe Begs Africa for Natural Gas

Things are getting desperate in Europe…the continent’s energy crisis is so dire that Poland and Germany are now circling a liquefied natural gas (LNG) project off the coast of Senegal – one that’s months away from even producing anything.

The African field, which is projected to contain about 15 trillion cubic feet of gas (that’s close to half the total volume of LNG the U.S. used in 2021 alone), is only 80% complete and won’t be ready to produce until the end of next year. But now that Russia has halted natural gas exports to Europe, the EU is thirsty.

The Kremlin announced that it would keep the gas taps shut off until the collective "West" lifted sanctions against the country. That means 40% of EU natural gas supply is now offline indefinitely.

There's just one problem: Replacing 40% of Europe's natural gas supply won't happen overnight. The European Commission estimates a total cost of €210 billion into infrastructure supporting new gas supplies, including new LNG import terminals, to eliminate the continent's energy dependence on Russia. But even these aggressive investments won't allow Europe to fully replace Russian energy supplies until 2027.

And that leaves the door wide open for Uncle Sam…

Over the past 10 years, U.S. natural gas production has risen over 50%. Today, America makes more natural gas than any other country.

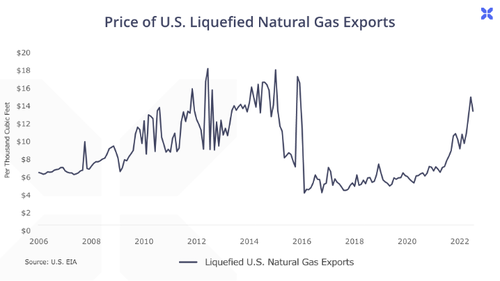

And as the U.S. exports more LNG, U.S. domestic gas markets are going to be increasingly linked to international prices.

That's why U.S. natural gas now trades at the highest levels since 2008, at over $12 per thousand cubic feet (mcf).

And what’s about to happen with U.S. natural gas is far bigger than any of these things...

American natural gas is emerging, right now, as the world’s next dominant energy source.

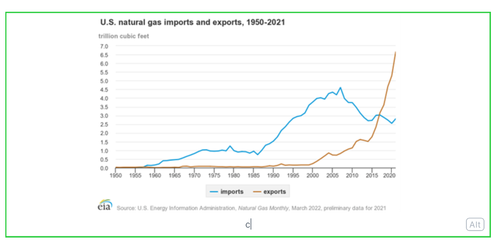

The U.S. began exporting significant natural gas quantities in the early 2000s via pipelines to Canada and Mexico. As U.S. production grew thanks to shale gas development (the U.S. became the world’s largest natural gas producer in 2009), exports increased rapidly.

Exports grew from less than half a billion cubic feet daily in the early 2000s to over two billion cubic feet daily in 2015.

Since 2015, export growth has been parabolic -- tripling from two billion cubic feet daily to over six billion cubic feet daily.

It’s difficult to find pure play natural gas stocks, but a number of large companies have sizeable exposure, like Total Energies (NYSE:TOT), Golar LNG Limited (NASDAQ: GLNG), and Shell (NYSE:RDS:A) (NYSE:RDS:B).

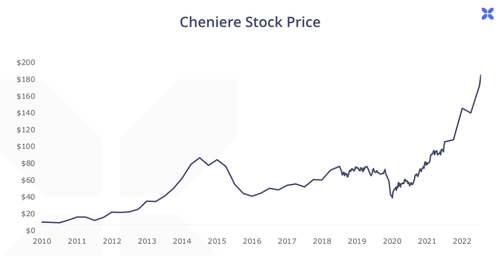

One pure play worth looking at is Cheniere Energy (NYSE:LNG). But it hasn’t always been… in fact, it was on our list of shorts years ago – until it got on the right side of history.

Back in 2006, Cheniere had the ill-advised business idea to import LNG to America – despite the fact that the U.S. was experiencing a glut of natural gas, not a shortage.

LNG shares were trading around $40 per share in 2006. By 2008, it had fallen to about $2.00—a complete collapse. But a funny thing happened on Cheniere’s route to bankruptcy…

In a case of real life being stranger than fiction, in 2009 the company completely reversed course in mid-construction and, rather than building LNG import facilities, reverse engineered and rebuilt their facilities to become LNG export facilities.

Ever since Cheniere got on the right side of the most important energy trade in the world – the inevitable global domination of U.S. natural gas – the stock has basically moved in a straight line from $2.00 to $178, to reach a market cap today of $44 billion.

Cheniere is the largest LNG exporter from America, filling a crucial bottleneck in global energy markets. With revenues of $25 billion annually, the company is projected to earn about $11 per share this year.

But Cheniere isn’t going to dominate the global markets. It doesn’t own any natural gas resources – it only owns the terminals.

No comments:

Post a Comment